Columbia Carbon ECOHUB

$24 Million Development Capital Raise

- The United States offers 45V tax credits or direct pay for clean hydrogen production with value unmatched anywhere; this project’s 45V is $1.9B (USD) over 10 years.

- NPV of $5.2B and $16B net income over 30-years. TIC of $635M.

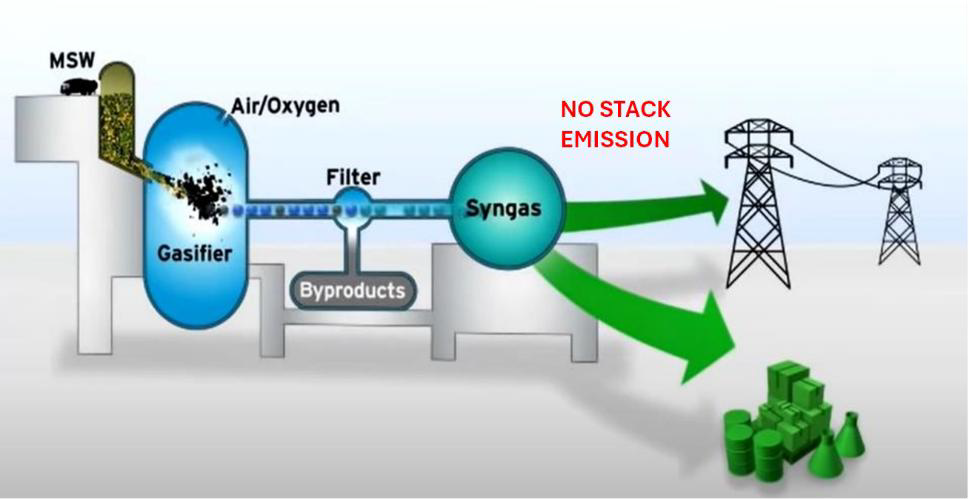

- ECOHUB redirects waste/biomass/(ocean) plastics to gasification/partial oxidation, bypassing landfills to eliminate methane leakage, the 3rd largest source of GHG.

- Synergy will build, own, and operate the 1600 TPD conversion technology project, making hedged green hydrogen and renewable gas, with SAF as a capital option.

- 100% recycling, negative emissions, saving more than 4 million tonnes CO2e/year.

- Proven no major permitting necessary – low risk, fast development schedule. Recognized as the cleanest, most efficient, least cost process by US EPA and CARB.

- Only large-scale production method of hydrogen (144 tonne/day) products, like RNG, not constrained by PFAS regulations, permitting, politics or economics.

- Meets RFS, RINs, LCFS, OR-CFP, CA-LCFS, and OR-HB2021 renewable requirements.

- Off-the-shelf, commercially available equipment, agnostic solutions.

- Non-combustion destruction of hazardous wastes, PFAS, creosol, and plastics

- Infrastructure is in place to serve multiple markets and avoid political risk.

Synergy ECO HUB Solutions, Inc. a Toronto based company, is soliciting development capital for MOIC or carried equity investment in its renewable fuels project in Oregon called the “Columbia Carbon ECOHUB.” Each phase will make pure hydrogen into 23 mmscfd of renewable natural gas for injection into GTN pipeline for utilities, transportation, and (LNG) export. More phases for SAF and ammonia options possible with local delivery. Tax credit options. International plastic termination and environmental attributes for energy storage and global delivery. International sites identified with continuous expansion at all sites possible. The Oregon project can subsidize later growth in less profitable international markets, add-on businesses, and Sustainable Energy Education Centers.

Economics

| Total Project Cost | $641M (USD) | DEVEX 1 (Tranche 1) | $3.6M |

| Payback | 1.8 years | DEVEX (Total to FID) | $24M |

| Average Revenue/EBITDA | $539M/$440M | PTC | $1.9B |

| Unlevered IRR | >40% | PrefEq/Equity/Debt | 9% / 31% / 60% |

| DEVEX 1 | |

|---|---|

| Engineering | $6,541,667 |

| Permitting | $930,000 |

| Land Matters | $7,476,667 |

| Legal | $473,611 |

| Marketing | $201,667 |

| G&A | $1,893,451 |

| Other | $225,000 |

| Project Mgmt | $4,541,458 |

| Contingency | $1,774,206 |

| Total | $24,057,727 |

Development capital and equity investment is into project SPE as non-recourse and uses land-banking as collateral adjacent to datacenters and industrial uses. Milestone gating-risk process releases the first tranche of $3.6M for site specific FEL-2 relying on design already in operations, then property purchase. FID by 1Q ‘26. COD estimated 1Q ‘28

Development capital and equity investment is into project SPE as non-recourse and uses land-banking as collateral adjacent to datacenters and industrial uses. Milestone gating-risk process releases the first tranche of $3.6M for site specific FEL-2 relying on design already in operations, then property purchase. FID by 1Q ‘26. COD estimated 1Q ‘28

OE and EPC contractors and vendors selected for LSTK contracts, with LDs, and PGs. Union construction and 40% or more domestic content, energy and economic depressed site, with potential tribal opportunities to maximize IRA tax credits of 45V PTC or 48 ITC. MACRS is also applicable.

Team

Our experienced team of solid waste specialists, waste to energy, process, and energy developers.

James K. Merritt, Jr. – CEO, 35-years in energy developing, building, and operating leading technologies, energy assets, and infrastructure. Launched Grannus, the largest zero emission CO2-H2-NH3 hub in U.S.

Lukasz Cianciara – CFO, 25-years in capital markets; private equity, project, power, infrastructure, and renewable energy finance.

Dirk Michels – GC, 30-years in major energy project organization and finance. Renewable Energy Attorney of the Year (2019) and Top 25 Clean Technology Lawyers in California.

Terry Harney – Founder, 15-years in waste handling, equipment sales, recycling, and RDF preparation.

Ron Icayan and David McConnell – Project management executives, prior POWER Engineers (P.E. OR & WA), Enerkem, Covanta, and Waste Management waste to energy and process projects.

POX Process and Project Details

POX, a 130-year-old technology, converts oxygen and carbon into high temperature (>1200°C) synthesis gas, then into hydrogen products and fuels without combustion emissions. Even (ocean) plastic is “Organic Fuel” per Oregon and Federal Regs.

Four reference plants are in operation internationally for 20 years using consortium members operating up to 300,000 TPY waste conversion per unit. That consortium will build 2 x 200,000 TPY units for its first U.S. installation under process patent licensing that guarantees Synergy’s market control along with BACT recognition. Our location can support unlimited growth and market

expansion into multiple fuels using existing waste and infrastructure. Building this first U.S. unit will control PACRIM hydrogen based markets and all business expansion into renewable fuels and chemicals.

Unique Selling Points and Circularity

- Synergy and consortium successfully resolved issues plaguing industry pioneers through lessons learned applied to engineering, equipment design, contracts, feedstock supply quality and resources, throughput, and economics. Each category has individual contingencies to continuously meet contracted output without dependence on other contingencies.

- Debottlenecking these contingencies after COD offers potential for higher revenue for TIC.

- 20-years of operations refined the consortium’s abilities to succeed.

- Experience in selection of heavy industrial land, existing interconnection and intermodal transit, design, and development skills eliminated majority of permitting risk. EPA precedent of no NEPA or air permits required. Declaration Letter of Exemption from EPA and listing in RBLC and BACT.

- Mandates for negative carbon intensity fuel passed by State legislators without resources to supply. Existing and planned alternatives will not meet obligations for GHG reduction. Only our ECOHUBs can provide enough fuel to meet obligations of GHG reductions to zero.

- Market competitors are damned by PFAS regulations and cancellations of green projects. Manufacturing Readiness Levels and Gigafactories will not meet demand without PFAS.

- Datacenters targeting same locations as ECOHUBs with potential for direct hydrogen sales.

This presentation does not constitute an offer to buy or sell securities. Prospective investors should not rely in whole or in part on this presentation. An offering can only be made pursuant to the delivery of a private placement memorandum and receipt of investment-related documentation. This document is based on information provided Synergy Eco Hub Solution, Inc. (the “Company”) and other sources the Company believes are reliable. The Company makes no representation or warranty that the information in this document is accurate or complete and is not responsible for this information. The Company has not acted on your behalf to independently verify the information in this document. Nothing in this document is, or may be relied upon as, a promise or representation as to the past or the future.